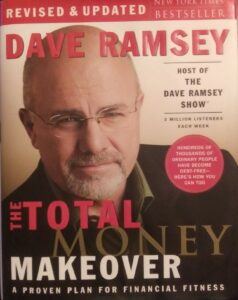

Becoming wisdom wealthy has been a process for me. When I started this journey, I was in at least $17,000 in student loan debt and $12,000 in car debt. Of all the vehicles I had previously owned, this was my first car debt. Listening to Dave Ramsey on the radio sparked my attention, and motivated me to use my savings to start tackling them one by one. Then I bought his book, The Total Money Makeover. I was so excited about sharing this book, I snapped a photo of my own book copy and posted it here below.

In The Total Money Makeover, author Dave Ramsey teaches that winning at money is 80% behavior and 20% head knowledge. His other motto that I have lived by is “If you will live like no one else, later you can live like no one else”. To help you live like no one else, he shares stories and testimonials of his audience’s debts and successes out of a series of 7 baby steps.

The Total Money Makeover – First Baby Step

Before running, you must first learn to walk. The Total Money Makeover encourages you to start saving your $1000  emergency fund. It helps to sell things you don’t need. This is a quick way to make $1000 and move to the next step. It doesn’t have to be limited to your job.

emergency fund. It helps to sell things you don’t need. This is a quick way to make $1000 and move to the next step. It doesn’t have to be limited to your job.

Why do you need an emergency fund? Simple…it’s for an emergency. Anything can happen such as sickness, car trouble, etc. These problems must be fixed, especially if you do not have health insurance or if your insurance does not cover all the medical bills. This $1000 can help keep you on track.

Keeping you on track with $1000 can help you decide to pause paying credit card bills or other bills that can wait like cable, credit card bills and so on. Bills that cannot wait are light bills, fixing your car, you or your child’s medical bills, etc.

The Debt Snowball

The Total Money Makeover also covers how to tackle baby step 2, which is what Dave calls the debt snowball. This is a psychological method of paying off the debt from smallest to largest. List your debts starting with the smallest payoff. Do not worry about interest rates unless you have two debts with similar payoffs like I did. Redo this sheet every time you pay off that debt. This helps you see how close you are to freedom.

Now that the old debt is paid, the new payment is found by adding all payments to the other debts that are listed above that item to the present payment you are working on. That will leave the remaining number of payments when you get down the snowball to that item. Before you know it, you are losing debt weight because your debt snowball is dwindling down to just one payment left.

Now that the old debt is paid, the new payment is found by adding all payments to the other debts that are listed above that item to the present payment you are working on. That will leave the remaining number of payments when you get down the snowball to that item. Before you know it, you are losing debt weight because your debt snowball is dwindling down to just one payment left.

I only had 2 large debts, so I worked on the smaller one in large chunks by above the minimum balance every pay period biweekly. I paid slightly over the minimum balance on the larger one monthly so that I could remain focused on tackling the smaller one, all while saving as much as I could while sacrificing unnecessary purchases. Before you know it, I had saved up enough to pay the remaining balance. Next, I tackled the other one that same year. I had paid off the remaining $12,000 off that same year!

Finally Live Like No one Else

The Total Money Makeover shares biblical principles on being good stewards of what you have. This includes giving at least 10% of your income to someone or a charity such as the local church you attend (online or in person).

If you can complete the first two baby steps, then you have achieved the freedom to accomplish the rest of the 7 baby steps. These steps have proven to work with effort and consistency. Baby Steps 3 -7 in this order are to save 3-6 mos. of expenses, invest 15% of your income into a retirement fund, save for your children’s college fund, pay off your home early, build wealth and give.

To do the rest of these take sacrifice. Remember selling items for an emergency fund? Continue selling items and refrain from buying their replacements. There is no better time like a pandemic time that you can make these decisions more easily. I seems difficult but it can still be done. I know from experience. I did not follow the steps immediately or even in the exact order all the time. It was gradual but achievable freedom.

My Review Conclusion

This review of The Total Money Makeover is based from my own experience and testimonial. I followed the book over a period of a few years because I would accumulate small debt again. More importantly, I paid it off again because these principles never left me. This book may not be for everyone, but you would not know for sure unless you try it. If you can start off with baby step one and two, keep working at those first two steps until you have mastered them. The rest of the seven baby steps will land into place and become like second nature to you.

Are you struggling with debt? Have you paid off any debt? Please share your comments. If you have experienced any debt, I encourage you to get The Total Money Makeover and try it. It can at least change your financial life just as it has changed mine. When does, Dave will have you yell at the top of your lungs, FREEDOM! Practice saying it too. You will feel so much better.

Hi, Michele,

I love reading Dave Ramsey’s columns. He gives really good financial advice.

Now, regarding your review of the book, I totally agree. It’s important to have an emergency fund. You never know when something can go wrong. I speak from experience. I’ve been laid off before, have been periods without insurance, etc. and if it had not been for that fund, I would’ve run into serious debt.

I’ve always tried not to borrow money from banks or other financial institutions unless it’s strictly necessary. I’d rather borrow from family or friends but try not to.

Thanks for sharing your review. I’m sure others will find it useful as well.

Hi Enrique,

Thanks for sharing your experience. I think so too. Biblically, borrowing just makes a person slave to the lender. That’s great that you took a better route and got out of debt with what you saved. It definitely saved your financial life. Thanks again and feel free to share this post with others..

Michele

Reading through your story will really influence someone’s thinking of success, believing that anything is possible, that all you need to do is believe and be hardworking. Making money online took me a lot of times before I discovered my buster and it’s turned into my full time job, online business is the Savior to many.

Thanks for your insight. Yes that’s true, belief + action can equal to success. However, even in all the hard work and full-time job, managing the money you make is even more important b/c so many make much but have nothing to show for it.